SERVICES

A goal without a plan is just a wish. We help you find your definition of financial success and create a roadmap towards achieving it, that starts with a comprehensive financial plan based on your unique nee

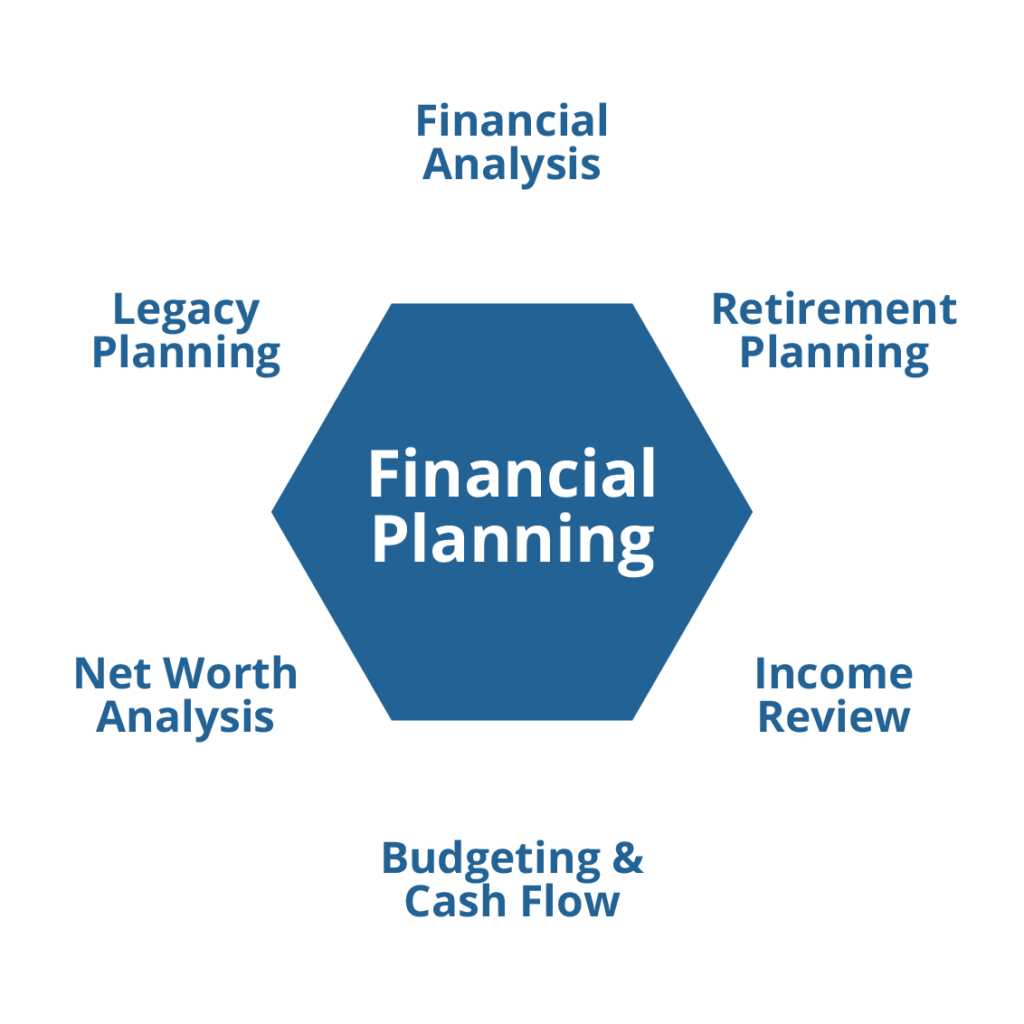

Financial Planning

Devoted to the craft of designing financial strategies that extend beyond mere investment yields, our team of Certified Financial Planners (CFP®) and advisors stand ready. We staunchly uphold the principle that strategic financial planning forms the fundamental basis for every relationship we cultivate. Anchored firmly in our Clarity Formula® process, we navigate through every facet of our clients’ financial journey, reaping a diverse array of benefits derived from a structured pursuit of financial independence. Among these advantages are:

Our unwavering Focus on Client Priorities:

Family – We delve into our clients’ most cherished relationships, understanding their aspirations for those dearest to them.

Occupation – Our insights extend to our clients’ professional ambitions, ensuring their financial plans align seamlessly.

Recreation – We acknowledge the importance of leisure pursuits, tailoring strategies to accommodate these interests.

Expert Control Over Manageable Variables:

Our approach hinges on maintaining focus on controllable elements.

In alignment with these principles, our distinguished financial planners offer an intelligent, holistic, and enduring plan curated to meet the unique needs of each client. This encompasses meticulous cash planning and money management, addressing the full spectrum of essential expenses associated with each plan. Delving into intricate financial particulars encompassing income, expenses, tax implications, and estate planning, our CFP® professionals furnish an all-encompassing blueprint complemented by invaluable financial counsel and steadfast discipline. This collaborative approach brings your wealth into sharp focus, nurturing its growth with expert precision.

Planning Strategy: Recognizing the uniqueness of everyone, no two clients share identical circumstances. Our planning strategy comprises three key components:

Design – Our insights extend to our clients’ professional ambitions, ensuring their financial plans align seamlessly.

Deploy – We acknowledge the importance of leisure pursuits, tailoring strategies to accommodate these interests.

Process: Beyond implementation, our commitment to our clients extends to a steadfast adherence to our well-defined process. As life unfolds and needs evolve, our process centers us on what truly matters and what we can control, guiding us towards a proactive and adaptable approach in charting the way forward.

Crafting an effective investment allocation demands a profound understanding of our clients’ and potential clients’ core values. We approach each situation with individualized attention, employing a comprehensive methodology.

Financial Planning

At the heart of our approach lies a deep exploration of key aspects:

• Identifying Priorities: Uncovering what holds paramount importance to you.

• Pursuing Goals: Delving into your aspirations and objectives.

• Safeguarding Interests: Understanding what you seek to protect.

• Setting Financial Milestones: Defining your overarching financial targets.

• Philanthropic Intentions: Exploring any charitable inclinations.

• Risk Evaluation: Assessing the suitability of your investment risk.

• Deferred Dreams: Addressing any long-awaited bucket list items.

• Retirement Aspirations: Establishing retirement timing and lifestyle.

• Financial Readiness: Ensuring adequate retirement savings.

Our Holistic Planning Approach

Philosophy – Our fundamental belief in achieving financial independence centers around the idea of embracing every aspect where money plays a role in your life. This principle serves as the foundation that empowers us to provide top-notch financial advisory services to our clients.

Planning Strategy – Each client stands as an individual, distinct in their needs and aspirations. Within this scope, our planning strategy comprises three essential facets:

- Exploration: Our goal is to have a comprehensive understanding of our clients’ present circumstances, the journey that brought them here, and their envisioned destination.

- Blueprint: Our team crafts a personalized roadmap meticulously tailored to the unique contours of our clients’ situations.

- Implementation: We meticulously execute the devised strategic blueprint.

Gauge your level of complexity

This chart lists most of the different aspects of financial planning. The levels represent the degree of complexity and will help you get an idea of how much financial planning will cost with Timothy Financial Counsel.

| Cash Flow Services | LEVEL 1 | LEVEL 2 | LEVEL 3 | LEVEL 4 | LEVEL 5 |

|---|---|---|---|---|---|

| Level and vehicle for emergency fund | ✓ | ✓ | ✓ | ✓ | ✓ |

| How/when to pay off debt | ✓ | ✓ | ✓ | ✓ | ✓ |

| Employment benefits review | ✓ | ✓ | ✓ | ✓ | ✓ |

| College Education Planning | ✓ | ✓ | ✓ | ✓ | ✓ |

| Contributions to 401(k) and IRA | ✓ | ✓ | ✓ | ✓ | ✓ |

| Five-year cash flow projection | ✓ | ✓ | ✓ | ✓ | ✓ |

| Retirement projections | ✓ | ✓ | ✓ | ✓ | ✓ |

| Income tax planning | ✓ | ✓ | ✓ | ✓ | ✓ |

| Home purchase decision | ✓ | ✓ | ✓ | ✓ | |

| Charitable giving strategy | ✓ | ✓ | ✓ | ✓ | |

| Social security planning | ✓ | ✓ | ✓ | ✓ | |

| Pension election planning | ✓ | ✓ | ✓ | ✓ | |

| Retirement withdrawal planning | ✓ | ✓ | ✓ | ✓ | |

| Timing of retirement | ✓ | ✓ | ✓ | ✓ | |

| Windfall planning | Basic | Low | Medium | High | |

| Stock options strategies | Low | Medium | High | ||

| Deferred compensation strategies | Low | Medium | High | ||

| Small business retirement planning | Low | Medium | High | ||

| Pre-65 healthcare planning | Low | Medium | High | ||

| Job / career change evaluation | Low | Medium | High |

| Investments Services | LEVEL 1 | LEVEL 2 | LEVEL 3 | LEVEL 4 | LEVEL 5 |

|---|---|---|---|---|---|

| Asset class allocation | ✓ | ✓ | ✓ | ✓ | ✓ |

| Specific advice for current employment retirement plan only | One | ||||

| Specific advice for multiple retirement accounts | Few | Some | Many | A lot | |

| Specific advice for multiple retirement and taxable accounts | Few | Some | Many | A lot | |

| Guidance on variable annuities | One | Few | Many |

Why do people hire us?

Validation

We offer clients an independent validation of their financial decisions.

“Am I on the right track?”

Ideation

We offer clients new ideas and strategies they may not have thought of on their own.

“Are there things I should be doing differently?”

Trusted Thought Partner

We are a trusted resource for you.

“Who will be my thought partner in the future when my situation or external circumstances change?”

Family Resource

We are a resource to your spouse and children.

“Who can help prepare my children to manage their finances well?”